Korean stars' corporate structures under tax scrutiny; industry group calls for clearer guidelines and recognition of their business roles.

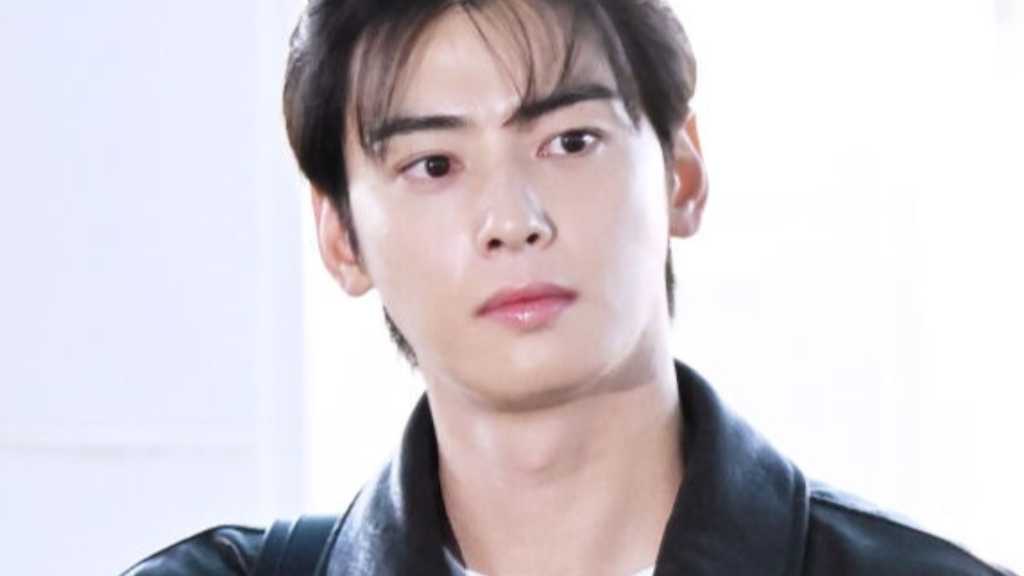

February/13/2026 12:11Recently, amid allegations of tax avoidance surrounding the establishment of personal corporations by K-pop stars like ASTRO's Cha Eun-woo and Kim Seon-ho, a professional organization in the entertainment industry pointed out issues with the current system and called for improvements. The Korea Management Association (KMA) issued a statement on the 12th, expressing regret over the tax authorities' approach of uniformly viewing personal corporations of entertainers as means of tax evasion. KMA diagnosed that 'K-content has emerged as a leading player in the global market, and the industrial structure has rapidly changed.' They analyzed that the Korean entertainment industry, which has grown based on the one-stop management system of the 1990s, has expanded globally, and some artists' revenue structures have effectively reached the stage of 'corporatization.' They explained that establishing personal corporations for artists to manage their careers, intellectual property rights (IP), and long-term brand value is a natural flow accompanying industrial development. However, the current tax administration views these personal corporations as 'conduits (paper companies)' to avoid progressive income tax rates, leading to repeated post-collection actions. KMA pointed out that 'this is an example of the system and administration not keeping up with the changed industrial structure.' They emphasized that personal corporations are not merely 'shells' for tax management but engage in substantial management activities such as mental care for artists, long-term career management, IP development, content planning, and bearing liabilities from exclusive contracts. KMA analyzed that the repeated issues of post-collection stem from a 'lack of standards' rather than 'malice.' They argued that the reason why the National Tax Service's actions are repeatedly overturned in tax trials and administrative lawsuits is due to the absence of clear and predictable tax standards. In response, KMA suggested that the government establish clear tax guidelines recognizing the industrial substance of personal corporations, create predictable tax standards reflecting the substantial roles and risks of corporations, improve systems to promote transparent operations rather than focusing on enforcement and collection, and provide positive administrative interpretations that do not undermine the global competitiveness of the K-culture industry. Finally, KMA emphasized that 'K-culture is the future industry of the Republic of Korea and a national brand,' stating that if we judge the structure that has driven its growth solely through the frame of tax evasion, we will stop our own growth engine. KMA earnestly appeals to the public and the government to recognize the realities of the industry and improve the system.

Related Articles

To combat tax evasion and improve transparency in the entertainment industry, South Korean lawmakers are proposing a new law requiring agencies to report their operations annually. This comes amid controversies involving artists like Cha Eun-woo, who is under investigation for tax issues. The law aims to hold accountable those with criminal records related to tax offenses.

Yoon San-ha celebrates his birthday with the third installment of his concert series, 'SANiGHT Project #3', in Korea and Japan. The concerts will take place on March 21 in Seoul, April 10 in Osaka, and April 12 in Tokyo, allowing him to connect meaningfully with fans while reflecting on his journey and promises.

The release date for Netflix's 'Wonderfools,' starring ASTRO's Cha Eun-woo, is planned for Q2 2023, but no specific date has been confirmed. Netflix denied reports of a May 15 release, stating discussions are ongoing. The series features a comedic action adventure plot set in 1999, with Cha Eun-woo and Park Eun-bin in lead roles.

The Korean Taxpayers Alliance has raised concerns about a tax information leak involving ASTRO's Cha Eun-woo. They plan to report unnamed tax officials and the journalist who first reported the leak for violations of privacy laws and public secrets. The Alliance emphasizes the illegality of such leaks and calls for a thorough investigation by the National Tax Service.

Chanu's advertising model contract with LG U+ has concluded. He was under investigation for tax issues last year, resulting in a large tax bill. LG U+ stated the contract ended due to the completion of the term and has no plans for renewal. This situation has sparked considerable discussion in the entertainment industry.

Amid tax evasion allegations against ASTRO's Cha Eun-woo, his agency clarifies that the eel restaurant linked to his family is a separate entity. Fantagio states that the restaurant in Cheongdam is not connected to the one in Ganghwa Island, and the claims of a connection are unfounded. The controversy centers on the legitimacy of a corporation established by Cha's mother, which the tax office deemed a 'paper company.'

January was eventful in the Korean entertainment scene, featuring BTS's comeback announcement and world tour dates, 2PM's Taecyeon revealing his fiancée's name during a live broadcast, BLACKPINK's Jennie's controversial birthday party, and ASTRO's Cha Eun-woo facing a tax scandal while in military service.

The Korean Taxpayer Alliance has defended ASTRO's Cha Eun-woo regarding a tax evasion allegation of approximately 20 billion won, arguing that presumption of innocence should be upheld. They criticized media assumptions about his mother's company being a shell corporation and highlighted the importance of taxpayer rights and proper legal processes.

ASTRO's Cha Eun-woo is under investigation for alleged tax evasion amounting to 20 billion won. His agency, Fantagio, confirmed a tax reassessment of 8.2 billion won, correcting earlier reports. Fantagio stated the main issue is whether a corporation established by Cha's mother is subject to taxation and plans to clarify legal interpretations while ensuring proper management of their artists moving forward.

ASTRO's Cha Eun-woo's company was investigated for tax issues by the Ganghwa County office, which coincided with its relocation to Seoul. Cha Eun-woo apologized for causing public concern and clarified that his military enlistment was not to evade tax issues. His agency stated they are cooperating with the investigation and will take necessary actions based on the findings.