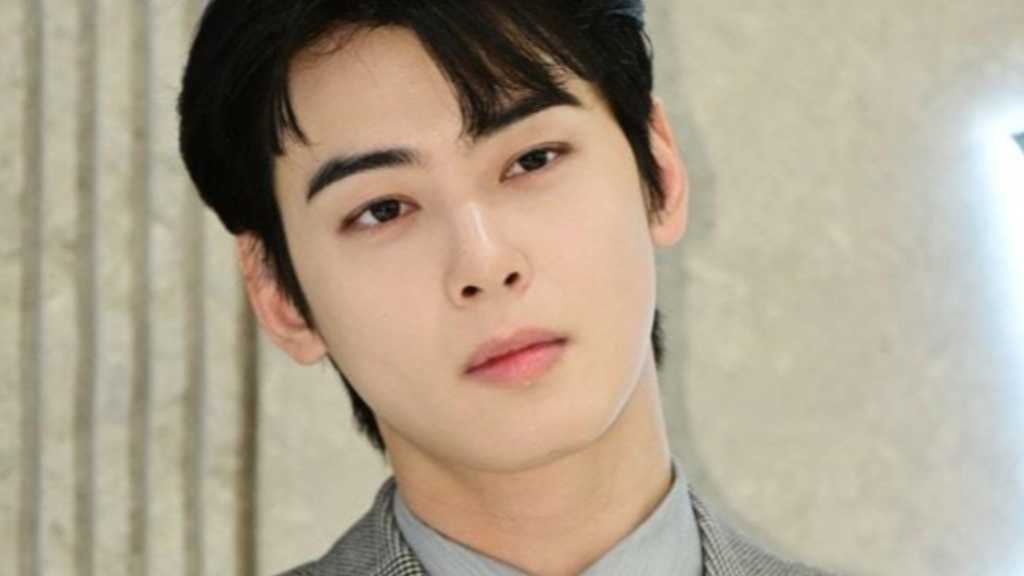

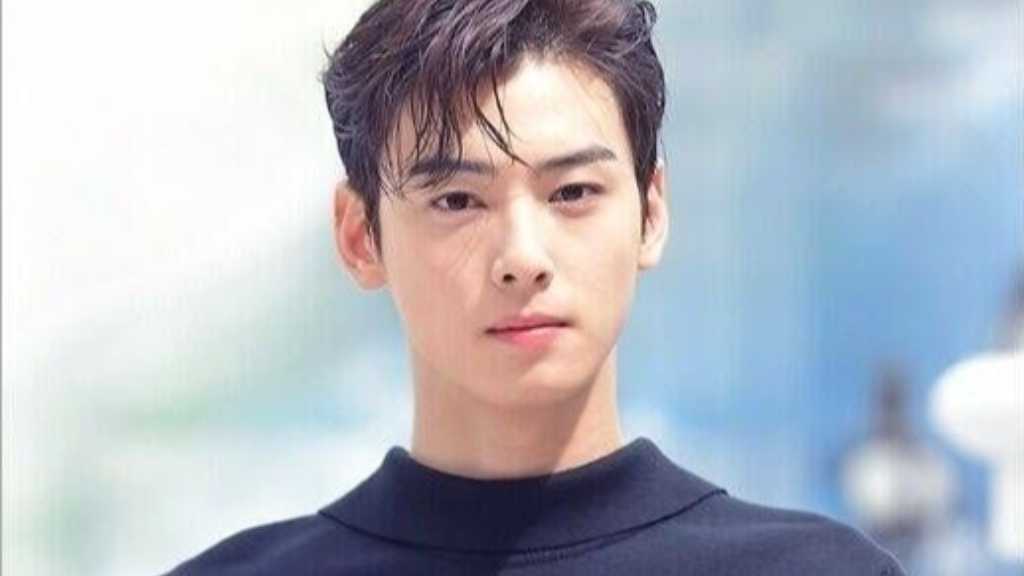

Korean Taxpayers Alliance raises concerns over tax info leak involving ASTRO's Cha Eun-woo and plans to report responsible parties.

February/10/2026 12:29The Korean Taxpayers Alliance, a tax specialist civic group, raised suspicions of tax information leakage following the tax-related turmoil involving ASTRO's Cha Eun-woo and clarified their policy for legal action. They view the leakage of information related to tax investigations as problematic and are expected to report the involved parties to the police. The Alliance stated yesterday (the 9th), "Tomorrow (the 10th) at 11 AM, we plan to report the unnamed tax official who leaked Cha Eun-woo's tax investigation-related information to the media, as well as the journalist who first reported it, for violations of the Personal Information Protection Act and suspicions of leaking public secrets under criminal law to the National Investigation Headquarters of the National Police Agency." They emphasized that the leakage of tax information itself is illegal and raised the need for truth verification at the National Tax Service level. The organization has previously expressed opinions on related matters, stating, "Tax avoidance is a taxpayer's right. If tax avoidance is successful, it becomes 'tax saving,' and if it fails, it becomes 'tax evasion,'" pointing out the complexity in distinguishing between tax saving and tax evasion. They also explained that taxpayers can assert their legal rights to reduce or avoid taxes imposed on them within the limits allowed by law, which should not be a problem. They criticized the process of disclosing tax information, stating, "The leakage of tax information is illegal," and argued that information regarding tax investigations of celebrities is difficult to report in the media without leakage by tax officials. They claimed that if the head of the National Tax Service does not investigate the existence of leaks and merely observes, it constitutes 'dereliction of duty.' Furthermore, they added that the National Tax Service should identify and severely punish the public officials who leaked Cha Eun-woo's tax information. It was recently revealed that Cha Eun-woo received a notification for additional taxation of around 20 billion won (approximately 2 billion yen) after being investigated by the 4th Investigation Bureau of the Seoul Regional National Tax Service last year. In response, Cha Eun-woo has requested a pre-tax eligibility review and is awaiting the results. His agency also stated that they will actively explain in accordance with the procedures.

Related Articles

To combat tax evasion and improve transparency in the entertainment industry, South Korean lawmakers are proposing a new law requiring agencies to report their operations annually. This comes amid controversies involving artists like Cha Eun-woo, who is under investigation for tax issues. The law aims to hold accountable those with criminal records related to tax offenses.

Amid tax avoidance allegations against stars like ASTRO's Cha Eun-woo, the Korean Management Association urges reforms. They argue that the current tax system misinterprets personal corporations as mere tax evasion tools, failing to recognize their legitimate business roles in managing artists' careers and intellectual properties.

Yoon San-ha celebrates his birthday with the third installment of his concert series, 'SANiGHT Project #3', in Korea and Japan. The concerts will take place on March 21 in Seoul, April 10 in Osaka, and April 12 in Tokyo, allowing him to connect meaningfully with fans while reflecting on his journey and promises.

The release date for Netflix's 'Wonderfools,' starring ASTRO's Cha Eun-woo, is planned for Q2 2023, but no specific date has been confirmed. Netflix denied reports of a May 15 release, stating discussions are ongoing. The series features a comedic action adventure plot set in 1999, with Cha Eun-woo and Park Eun-bin in lead roles.

Chanu's advertising model contract with LG U+ has concluded. He was under investigation for tax issues last year, resulting in a large tax bill. LG U+ stated the contract ended due to the completion of the term and has no plans for renewal. This situation has sparked considerable discussion in the entertainment industry.

Amid tax evasion allegations against ASTRO's Cha Eun-woo, his agency clarifies that the eel restaurant linked to his family is a separate entity. Fantagio states that the restaurant in Cheongdam is not connected to the one in Ganghwa Island, and the claims of a connection are unfounded. The controversy centers on the legitimacy of a corporation established by Cha's mother, which the tax office deemed a 'paper company.'

January was eventful in the Korean entertainment scene, featuring BTS's comeback announcement and world tour dates, 2PM's Taecyeon revealing his fiancée's name during a live broadcast, BLACKPINK's Jennie's controversial birthday party, and ASTRO's Cha Eun-woo facing a tax scandal while in military service.

The Korean Taxpayer Alliance has defended ASTRO's Cha Eun-woo regarding a tax evasion allegation of approximately 20 billion won, arguing that presumption of innocence should be upheld. They criticized media assumptions about his mother's company being a shell corporation and highlighted the importance of taxpayer rights and proper legal processes.

ASTRO's Cha Eun-woo is under investigation for alleged tax evasion amounting to 20 billion won. His agency, Fantagio, confirmed a tax reassessment of 8.2 billion won, correcting earlier reports. Fantagio stated the main issue is whether a corporation established by Cha's mother is subject to taxation and plans to clarify legal interpretations while ensuring proper management of their artists moving forward.

ASTRO's Cha Eun-woo's company was investigated for tax issues by the Ganghwa County office, which coincided with its relocation to Seoul. Cha Eun-woo apologized for causing public concern and clarified that his military enlistment was not to evade tax issues. His agency stated they are cooperating with the investigation and will take necessary actions based on the findings.